Financial Preparation Suggestions For Your 40S And 50S

Financial Preparation Suggestions For Your 40S And 50S

Blog Article

Are you running out of time for retirement preparation? Everybody wishes to retire at some point and everybody deserves to as long as they strive best? The issue is that not everyone performs their retirement planning the method they should to make sure that they will have enough when the time comes. But, even if this describes you, it does not need to and you can keep time from running out if you wish to.

When you have actually considered the above concerns you can then start working through your retirement monetary planning. Be cautious of guidance by people who might have their own interests at heart, and you are merely a fee source for their own retirement plan! Try and recognise the difference between "skilled recommendations" and what Nassim Taleb calls "professionals. who are not professionals." Tax law and financial structuring is in the first classification and all "future price quotes (guesses)" in the 2nd.

Females do not work as long as guys do at the same task. This is because of requiring time off to take care of the family to raise the kids. So ladies don't construct up the needed years to receive a substantial pension or retirement plan, leaving them with little or no cost savings from the companies they are working for.

A crucial thing to bear in mind is to approximate one's costs after retirement. If one has a rough price quote of one's costs, everyday and significant costs, then it becomes easier to save much better. If you have an idea of how much you might spend, then it will not be monetarily difficult for you at that time, as you already would have cost savings to pull you through. It would be strongly advised to have a good medical insurance policy. Retirement age brings health problems and you will require additional money to bear such expenditures in case they show up. You ought to also try to take great care of your health to avoid such expenditures.

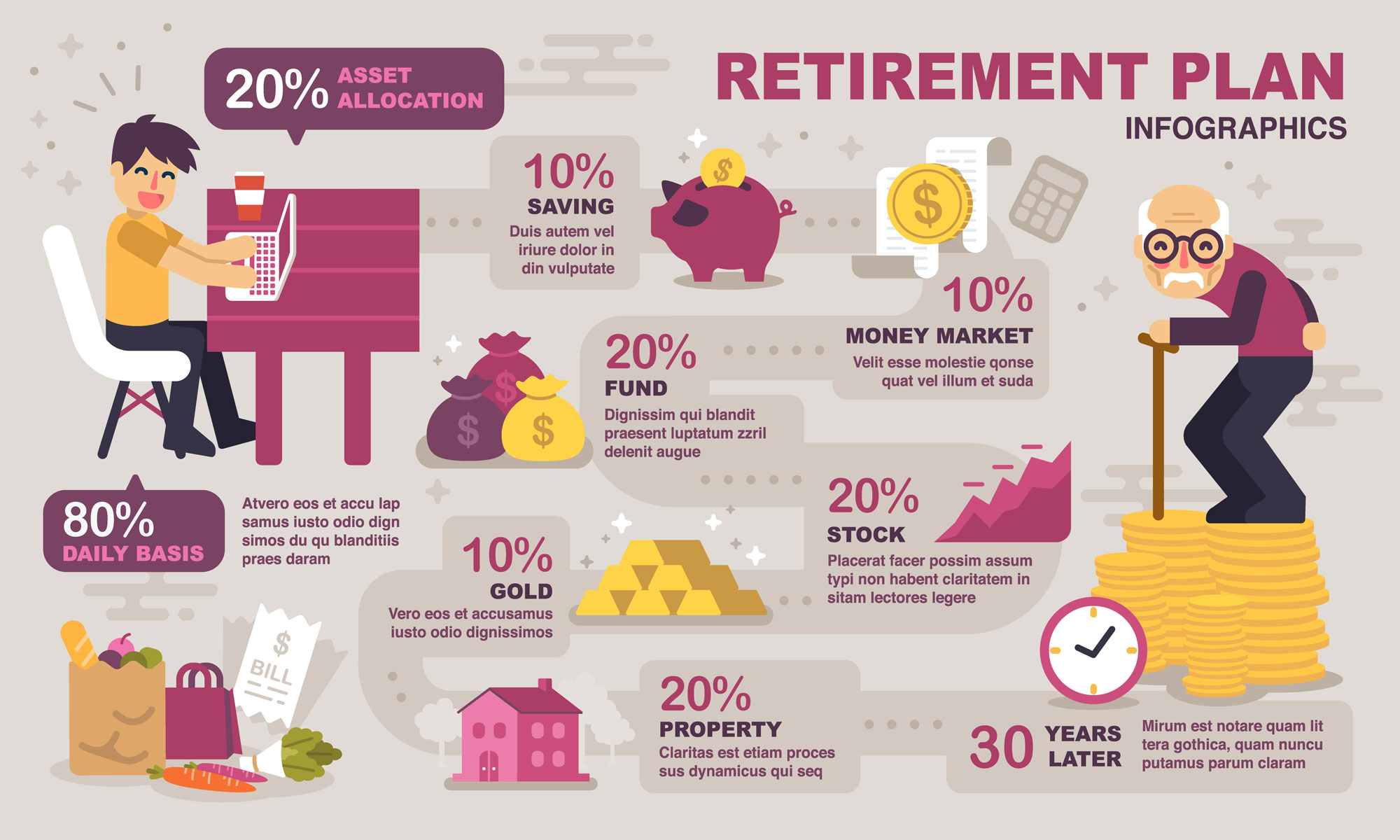

Take your time and consider where you desire to put your cash for retirement. The choices are going to be frustrating due to the fact that there are a lot of of them. You wish to be sure that you are choosing the right investments for your retirement planning so that you do not get bit later on down the roadway. You want to keep your eyes on what they are doing and how well your cash is being invested. You need to never entirely trust anybody with your cash since your retirement planning is too crucial to miss out on out on.

For circumstances, you and your partner need to both make a list of things you never ever wish to do once again and another list of what you desire to accomplish in retirement. Not working is not a definable goal. Why both of you? You may be surprised if the two lists do not look from retirement planning another location the exact same. Much better to learn now the differences, and contracts, and create a compromise list. This can be a mind-blowing experience.just do it.

The sooner you start to save and plan for your retirement years, the more ready you will be. The power of intensifying methods that with early preparation a small financial investment each year might possibly create a portfolio large enough to satisfy your retirement requirements.

Report this page